Energy / Offshore wind plans include sites to east and west of Shetland

AN OFFSHORE wind developer has unveiled more details about its plans for waters off Scotland – and they include sites both to the west and east of Shetland.

Cerulean Winds said they will apply for the rights to four sites in Crown Estate Scotland’s Innovation and Targeted Oil and Gas (INTOG) auction next month – a scheme for floating wind projects to decarbonise oil platforms.

The company previously revealed it was proposing large floating wind sites to the west of Shetland, and also the central North SeaOffshore wind developer confident of securing licence for floating turbines west of Shetland.

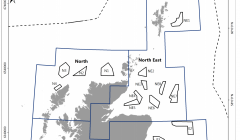

But its multi-billion pound plans for the INTOG auction show there is also a site planned for the east of Shetland, and another in the central North Sea – four in total.

It also reiterates a previous proposal for a processing plant in Shetland to covert excess power to green hydrogen.

The company hopes to assist oil and gas developers in the route to net zero by offering green power.

The sites are expected to cost around £6 billion each to develop and if successful Cerulean estimates the work would create over 10,000 UK jobs.

The company has previously been criticised by unions for contracting a United Arab Emirates based business for the fabrication, assembly and outfitting parts to be used as floating foundations.

But Cerulean says it has pledged that fabrication of the foundations and towers will take place in the UK.

It added that the “expectation is for our partners to be in the UK” to build out capacity for heavy fabrication and the “levels of work involved would lead to substantial inward investment in the Scottish economy”.

There is an acceptance that not everything can be carried out in the UK – but the company is actively engaging with British yards.

Become a member of Shetland News

The company added that the plans are modular and can therefore be built up “like a Lego set for energy generation”.

Each area would require about one million tonnes of steel for foundations and the towers.

Each site would be funded via a special purpose vehicle (SPV), owned by Cerulean Winds and institutional investors, covering 30 per cent of the capital needed.

The remaining 70 per cent of funds would be drawn from the infrastructure debt market, where investment banks Societe Generale and Piper Sandler have been engaged.

Cerulean said it has no concerns over meeting the funding targets, with investors said to be sitting “on stand-by” – but money will not be released until INTOG leases are secured.

Become a member of Shetland News

Shetland News is asking its many readers to consider paying for membership to get additional features and services: -

- Remove non-local ads;

- Bookmark posts to read later;

- Exclusive curated weekly newsletter;

- Hide membership messages;

- Comments open for discussion.

If you appreciate what we do and feel strongly about impartial local journalism, then please become a member of Shetland News by either making a single payment, or setting up a monthly, quarterly or yearly subscription.